Capital is the lifeblood of any business. As well as supporting long term investment, working capital is used to invest in the current assets used in a company’s day-to-day operations.

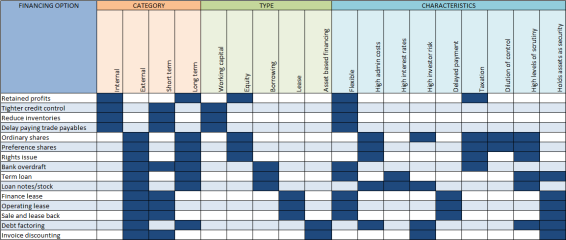

Businesses have multiple ways of raising finance which may be suitable depending on the characteristics of the firm, the nature of the intended investment and the economic environment. To simply the advantages and disadvantages of these options, HBR has compiled the following table (click to enlarge).

Note: This table shows the general characteristics of financing options. However, most change according to factors such as business reputation, credit ratings, market conditions and service used.

DEFINITIONS

Internal sources of finance

Retained profits:

Companies can increase funds by retaining profits and not distributing them as dividends. The shareholders deprived of capital will expect retained profits to be invested to achieve a competitive rate of return. Most big businesses retain 50% of profits to fund expansion.

Tighter credit control:

The remaining internal financing options increase businesses’ cash assets by decreasing working capital items. For example, chasing trade receivables owed by credit customers releases funds which can be re-invested in the business.

Reduce inventories:

Purchase and storage costs use revenue that could otherwise be used to expand the business. However, when reducing inventories enterprises should be careful to retain the capacity to meet future demand.

Delay paying trade payables:

This cheap form of finance extends the period before a business has to make good on their credit payments, releasing the funds in the interim. This can come at a reputational cost, which damages the possibility of buying on credit in the future.

External sources of finance

Ordinary shares:

Under this arrangement, companies raise capital by selling stock in their business. This entitles the purchaser to a voice in the decisions made by the firm. While ordinary shares do not have a fixed rate of dividend (a share of company profits) from profits after current liabilities and other investors are services, not paying them can diminish share value. A business will avoid this if they hope to issue shares in the future.

Preference shares:

Preferential shareholders receive dividends before individuals with ordinary shares. Their lower risk and lower levels of return mean that preference shares have a less volatile market price. These have lost popularity since, while they are alike borrowings in many other aspects, dividend payments are not tax deductible.

Rights issue:

In order to raise finance without diluting control of the business, a rights issue offers new shares to existing shareholders. Shares issued this way generate goodwill and maintain the predictability of shareholder governance, but must also be discounted (sold at an average of 31% under market price).

Bank overdraft:

Businesses can access funds by maintaining a negative balance on its bank account. The advantages of using an overdraft include flexibility, competitive interest rates and can become a long term source of finance (dependent on the confidence inspired by the borrower). But, reliance on an overdraft can have devastating consequences, since it is repayable on demand.

Term loan:

Financial institutions provide negotiable loans in which the rate of interest, repayment dates and security for the capital offered must be agreed. Because they are commonplace, this option is easy to set up and has a degree of flexibility. At the same time, borrowed capital often comes with obligations and restrictions known as ‘loan covenants’.

Loan notes/stock:

This form of borrowing, exchanges capital from investors for a note representing the loan which can then be traded on the Stock Market. The value of a loan note fluctuates with the business’s performance.

Finance lease:

Under this arrangement, a business will select an asset which is then purchased by a finance company. The lease will then be paid in a series of rentals or instalments. This avoids the large cash outflows of an outright purchase. The risks and rewards associated with the purchased item are transferred to the lessee.

Operating lease:

This is similar to the finance lease, except the rewards and risks of the item stay with the owner. The asset becomes security, meaning that operating leases are usually given without detailed credit checks. The term of an operating lease is short compared to the useful life of the asset, and so the asset might be used by multiple lessees in its lifetime. Businesses can, therefore, avoid obsolesce risks by this means.

Sale and lease back:

Businesses can raise funds by leasing their unused assets to a financial institution.

Debt factoring:

Debt collection can be outsourced to specialist subcontractors. This can increase cash assets by providing savings in credit management and certainty in cash flows. Stakeholder opinion should be considered before opting for this financing option, as the use of outside agents could be viewed as an indication of financial difficulties.

Invoice discounting:

This is a loan based on the value of a business’s outstanding credit sales. This is used as a short term alternative to debt factoring. It is more widely used based on its low service charges and the autonomy it gives to the business to collect payment for its own credit sales. However, repayment of the advance not dependent on trade receivables being collected, so a business must have confidence they can raise finance within the term of the loan.